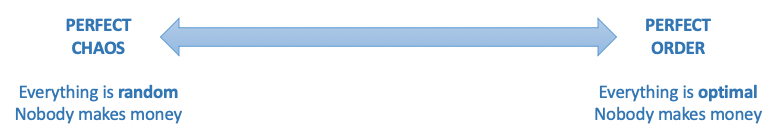

There are two extremes of market efficiency that are bad for active investors.

At one extreme, markets are perfectly efficient and prices exactly reflect underlying economic reality. Nothing is ever cheap or rich relative to its “fair value”, and hence there are no oppportunities to profit.

At the other extreme, markets are perfectly inefficient and prices are random. Opportunities abound: many assets appear cheap or rich. But since prices never converge to fair value, you can’t profit in this scenario either.

As an investor, you want just the right amount of inefficiency: not too little, not too much. Like Goldilocks’ soup, or more tellingly, St Augustine’s prayer: “Lord, make me pure … but not just yet”.

Even better is a small degree of inefficiency that only you can identify – meaning you can take advantage of opportunities that nobody else can. This of course is the premise of all hedge funds and indeed all active managers: their ability to spot such inefficiencies, aka their edge.

What’s the analogy for technology startups?

You want your startup to solve a problem that is extremely difficult, but just this side of impossible.

Impossible problems are like inefficient markets: opportunities are plentiful, but there’s no way to take advantage of them. Easy problems are like efficient markets: any opportunity has been arbitraged away by competitive forces. Very difficult, borderline-impossible problems are the sweet spot: just the right amount of inefficiency to make them worthwhile to solve.

Ideally, you want to attack the problem just as macro trends (technology, economics, behaviour) move it across the boundary between impossible and merely difficult. This is the logic behind Sequoia’s famous “why now?” question.

Also ideally, you want to be the only one who can perceive that transition. This is the logic behind Peter Thiel’s “secrets” filter; it’s just the edge thesis reframed.

There’s even a social-benefit component to the analogy. Society as a whole benefits when problems move from impossible to difficult to easy. Society also benefits when prices move towards economic reality. In both cases, those driving the moves – innovators, investors – capture part of the rewards, creating the incentives for them to act. That’s why markets and technology work!